1. INTRODUCTION AND CONTEXT

The Sustainable Finance Disclosures Regulation (Regulation (EU) 2019/2088) of the European Parliament and of the Council of 27 November 2019 on sustainability-related disclosures in the financial services sector (“SFDR“) requires firms that manage investment funds and other collective investment schemes to provide transparency on how they integrate sustainability considerations into the investment process with respect to the funds and schemes they manage. The SFDR was supplemented and amended by (i) the Framework to Facilitate Sustainable Investment and amending the SFDR (EU) 2019/2088 (Regulation (EU) 2020/852) of the European Parliament and of the Council of 18 June 2020 (“Taxonomy Regulation”) and (ii) the Regulatory Technical Standards (Regulation (EU) 2022/1288) of the Commission of 6 April 2022 (“RTS”).

Throughout the lifespan of Bright Ventures Capital, SCR, S.A. (“Bright Ventures”) investments and as an active investor with representation on the governance bodies of our portfolio entities, we engage actively with our portfolio companies so that together we identify and manage ESG risks, to the extent (i) such entities are subject to the ESG regulations and, in particular, Taxonomy Regulation and/or (ii) any such risks are identified by the entities in question, and try, if possible, to help such entities reducing any sustainability adverse impacts.

2. NO CONSIDERATION OF ADVERSE IMPACTS OF INVESTMENT DECISIONS ON SUSTAINABILITY FACTORS STATEMENT

The SFDR requires the fund managers that are not covered by SFDR’s criteria set out in Article 4(3) and (4) of the SFDR to disclose if they consider adverse impacts of their investment decisions on sustainability factors, namely, to make a “comply or explain” decision whether to consider the principal adverse impacts (“PAIs“) of its investment decisions on sustainability factors, in accordance with a specific regime outlined in SFDR, in the Taxonomy Regulation and in the RTS (the “PAI regime”).

Bright Ventures is not covered by the above SFDR’s criteria which applies to larger institutions and, accordingly, has exercised its option not to comply with the PAI regime, both generally and in relation to the Funds under management, hereby stating that it does not take into consideration the adverse impacts of its investment decisions on sustainability factors.

Bright Ventures has thoroughly assessed the requirements of the PAI Regime and is supportive of the goals pursued by the PAI regime. However, Bright Ventures understands not to be in conditions to opt to comply with the requirements of the PAI regime, due to its size, nature and the scale of its activities and, as in particular, considering that:

(i) its investment scope is limited to sectors and geographic areas that entail limited adverse impacts on sustainability,

(ii) it invests in small entities and start-ups that, due to their size and limited resources, are not capable of providing the information required to determine precisely the adverse impacts of the investment decisions in accordance with the SFDR, the Taxonomy Regulation and the RTS,

(iii) it’s an organisation with limited resources and personnel and not capable of determining precisely what the adverse impacts of its investment decisions would be, based on the different criteria set forth in the SFDR, the Taxonomy Regulation and the RTS, and

(iv) companies and market data providers are not yet ready to make available all necessary data for the PAI regime. In practice, access to information on sustainability factors requires the use of external information sources, involving high costs that are disproportionate to the investment policy of the funds currently under management.

Currently Bright Ventures does not market or manage funds that promote, among others, environmental or social characteristics or a combination of both (as set out in Article 8 of the SFDR) nor those aimed at sustainable investments (as set forth in Article 9 of the SFDR). As such, the underlying investments of said funds do not consider the EU criteria applicable to environmentally sustainable economic activities.

Bright Ventures will keep its decision not to comply with the PAI regime under regular review but despite such current decision, Bright Ventures is aware that its investment decisions, as well as its portfolio entities’ activities may have an impact on sustainability factors and, as such, takes into account, whenever applicable, constructive ESG-related initiatives and policies, as part of Bright Ventures´ overall commitment to ESG matters, benefiting, in particular, from being part of a Corporate Group – Sonae – that highly values its commitment to ESG matters.

3. INTEGRATION OF SUSTAINABILITY RISKS INTO INVESTMENT DECISION-MAKING PROCESSES

(I)

As a company integrated in Sonae Group, Bright Venture’ mission is focused on creating long-term economic and social value, taking the benefits of progress and innovation to an ever-increasing number of people. Recognizing the utmost importance of adhering to stringent sustainability principles within its strategy, Bright Ventures strongly emphasizes adopting a management approach according to Environmental, Social, and Governance (hereinafter, “ESG”) criteria.

In its determined pursuit of new investments, Bright Ventures strives to promote a flexible investment approach coupled with a solid corporate governance model. Bright Ventures is supported by Sonae Group in the development of an ESG strategy and roadmap aligned with their stakeholders and objectives, while actively contributing to the Group’s own ESG commitments. This global and sustainable approach enables Bright Ventures to work with the right companies and management teams to achieve its goals in a responsible way.

Bright Ventures’ commitment to sustainability is deeply rooted in its culture and identity, and its dedication is reflected in this Sustainability Policy as an integral part of its mission.

(II)

Bright Ventures shall ensure compliance with all applicable local, international and EU regulations, as well as with the reporting requirements specific to each jurisdiction. This Policy is guided by best practices as set out in international conventions, protocols, and guidelines, including the following:

• Principles for Responsible Investment (UNPRI or PRI)

• OECD Principles of Corporate Governance

• UN Convention on Corruption

• UN Guiding Principles on Business and Human Rights

• The Universal Declaration of Human Rights

• The Convention on the Rights of the Child

• Rio Declaration on Environment and Development

• United Nations Global Compact

• The International Labour Organization’s Tripartite Declaration of Principles Concerning Multinational Enterprises and Social Policy

• Other globally recognised references regarding environmental, social and governance requirements.

Sonae Group – including Bright Ventures – actively engages with various standard-setters and stakeholders locally and internationally. Sonae Group – including Bright Ventures – actively participates in the reporting of the Sustainability Accounting Standards Board (SASB), the Climate Disclosure Project (CDP), and is firmly aligned with EU Taxonomy, Corporate Sustainability Reporting Directive and with the Sustainable Finance Disclosure Regulation (SFDR).

Bright Ventures’ business approach aims to always be aligned with its corporate values focused on the main sustainability principles. Bright Ventures ensures that its governance values are reinforced with the sustainability core values resonating throughout its portfolio. This is achieved through mechanisms that allow informed decision-making, effective internal processes, and adequate response to ESG topics.

(III)

As an active portfolio manager, Bright Ventures establishes procedures and initiatives aimed at enhancing ESG aspects across its investment process. Throughout the different phases of the investment process, Bright Ventures understands the relevance of upholding best-in-class ESG criteria, in addition to more traditional economic and financial variables, striving to achieve meaningful impact today that ensures a better tomorrow for all.

Building on Sonae Group’s Mission and its unwavering dedication to the value ´Do what´s right´, a set of exclusion principles is embedded in our way of doing business and will guide us throughout the investment evaluation process. In that sense, whenever any issues emerge related to the practices below, this shall result in an immediate termination of the investment consideration:

a) Violation of international human rights standards;

b) Violation of animal rights;

c) Corruption and bribery;

d) Unethical and illegal labour and business practices;

e) Carbon intense operations;

f) Environmental impacts related to unmanaged waste, water pollution, chemical contamination or destruction of high conservation value areas.

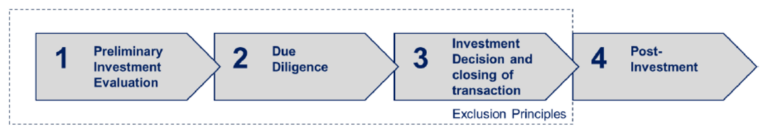

The Responsible Investment procedure can be broadly described as follows:

1. Preliminary Investment Evaluation

Bright Ventures undertakes a screening process to preliminarily assess potential ESG impacts, risks and opportunities arising in relation to the industry and country(ies) of operation of an identified investment opportunity. As part of this initial assessment, potential critical areas to investigate further are identified by reviewing a checklist with relevant/critical ESG questions. This evaluation is presented, together with other investment criteria, to Bright Ventures’ governing body, that determines whether to further proceed or not with the investment process.

2. Due Diligence

If the initial investment evaluation is positive, the potential target is subjected to more exhaustive scrutiny, to identify and address material ESG impacts, risks and opportunities.

In this phase a variety of ESG factors are addressed, including climate change, environmental impact, gender equality, health and safety, human rights, labour practices and governance topics, alongside other non-ESG considerations such as legal, commercial, financial and tax.

All relevant information obtained in the due diligence exercise is reported to the competent governing body of Bright Ventures.

3. Investment Decision and Transaction Completion

During this stage of the investment process, Bright Venture’ relevant governing body determines whether to proceed or not with the proposed investment. This decision is based upon a variety of factors, including ESG considerations alongside other key criteria such as strategic, legal, commercial and financial implications for Bright Ventures and its managed fund. If the decision is to proceed, final negotiations with the relevant counterparty are taken to conclusion, aimed at signing binding acquisition documentation and proceeding to swift completion of the investment transaction.

4. Post-Investment

Concerns identified in due diligence phase are addressed and subsequently subjected to ongoing review and monitoring. Prior to acquisition completion, an action plan – which includes ESG risks and improvement opportunities, if any – is developed, outlining specific short, medium and long-term measures to eliminate, reduce or mitigate all key risks previously identified.

4. REMUNERATION POLICY AND SUSTAINABILITY

Bright Ventures remuneration policy complies with the applicable laws and follows international standards. It targets an alignment of interests between investors and the fund manager, avoiding incentives for inappropriate risk taking, being in line with its sustainable long-term financial development and consistent with the integration of sustainability risks, in accordance with the SFDR.

The remuneration policy is crafted to support and protect Bright Ventures’ goals related to business and managed funds financial performance, ESG and sustainability, and the ultimate aim of delivering long-term value to the funds’ LPs, as well as other stakeholders, including colleagues, industry peers, and the global community. The policy aims to attract, retain, and motivate talent while aligning employee interests with those of the relevant stakeholders.

The remuneration policy outlines the structure and guidance for the total remuneration package, which includes: (1) fixed salary, (2) variable compensation (bonus), and (3) other non-monetary benefits such as flexible working arrangements and health insurance. The composition of each employee’s total remuneration package depends on their position, responsibilities, capabilities, and performance.

Several factors influence remuneration levels, including the financial performance of the funds and the GP during the relevant period, the team’s contribution to achieving the firm’s and funds’ strategic and operational objectives, adherence to risk management, compliance with internal and external rules, management and leadership capabilities, and, within the variable compensation evaluation, the efforts and results in pursuing the firm’s ESG policy and principles in their work. Such evaluation of ESG factors in the variable component of the remuneration policy to promote responsible investment and sustainable business practices is based on the following criteria:

Performance Metrics: Employee performance will also be assessed based on contributions to ESG objectives, including reducing environmental impact, improving social outcomes, and enhancing governance practices.

Qualitative Assessment: In addition to financial performance, qualitative factors such as adherence to ESG principles, leadership in ESG initiatives, and feedback from internal and external stakeholders may influence remuneration decisions.

Risk Management: Compliance with ESG current and future risk management protocols may be a factor in determining remuneration levels.

Many of these factors are qualitative and based on internal and external feedback for each team member.

5. CONCLUSION

As a final note, we emphasize that Bright Ventures is fully aware of the importance of sustainable practices within the financial system and of its responsibility as a fund manager to encourage its portfolio companies to introduce sustainability principles into their management.

This is a matter under continuous review and Bright Ventures’ commitment will be at all moments to combine its investment strategy and goals with the active promotion of sustainability factors.

Last Updated on July 8th, 2024

Approved and first published on August 7th, 2023